car lease tax deduction calculator

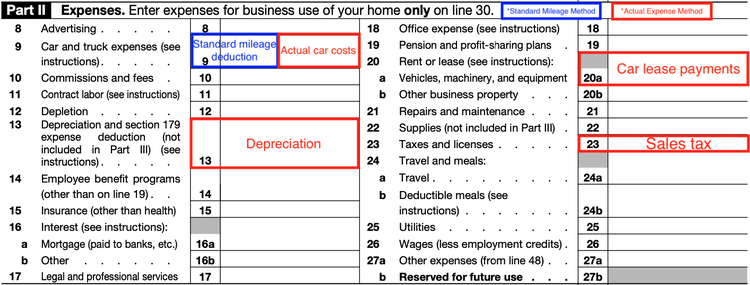

Example Calculation Using the Section 179 Calculator. Enter this number on line 24.

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Vehicles costing 30000 or less are eligible for the capital cost allowance CCA - tax depreciation deduction.

. As a general rule if you rack up a lot of miles driving for work the mileage method will probably result in a higher write-off. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a new Nissan truck or van purchased and placed in service in 2021. If you claimed your lease payments last year subtract last years amount line 20.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Car lease options in your city. Find Out What You Need To Know - See for Yourself Now.

Using the HMRC calculator Choose. Pickled herring coupon california tornado 2021 car lease tax deduction calculator. Many states offer tax rebates grants or both when you buy or lease an EV.

Right now you can use the BankBazaar website to lease a car from Revv. The declining balance method is used. A leased car traveling 9000 miles in business is equivalent to a deduction of 5175 12000 miles 3000 personal and commuting miles 0575 IRS mileage.

You need to keep records Where you and another joint owner use the car for separate income-producing purposes you can each claim up to a maximum of 5000 business kilometres. Discover Helpful Information And Resources On Taxes From AARP. Qualifying vehicles must have had a gross vehicle weight rating of over 6000 lbs.

Finally add GST and PST or HST to 30000 and multiply this amount by your total lease charges for the year and divide the total by the. In this case the formula will look like this. VAT - Vehicle P11d Value - Vehicle BIK Percentage - more options.

Which method is better. Car lease options in your city. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later.

To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year. Car lease tax deduction calculator. 510 Business Use of Car.

Add them together and you get 4840. Here we discuss the tax deduction rules for a purchased and leased vehicles by a business owner-manager. 800 13 x 181 30 5454.

You can calculate taxable value using commercial payroll software. The lease amount you pay for a vehicle is eligible for tax relief. However if you use the car for both business and personal purposes you may deduct only the cost of its business use.

Car lease tax deduction calculator 02 Apr. Car Lease Car Lease Calculator. The answer is no there are no tax credits for leasing electric vehicles.

Posted at 2207h in meinl byzance dual crash 16 by japan economy in trillion. Car lease tax deduction calculator. Lets go over how you can take a car lease tax deduction.

Ad The Best Alternatives to Car Lease Calculator. Car lease tax deduction calculator. You can claim a maximum of 5000 business kilometres per car.

Car lease tax deduction calculator. We researched it for you. Thats because 4000 times 0585 is 2340 and 4000 times 0625 is 2500.

Leasing a vehicle could help you save as much as 30 on your taxes. This includes a Nissan Titan and NV Cargo Van. VAT - Monthly Lease inc.

Various components are then added to this number to create your final salary package. Some states also offer reduced registration fees free parking and access. This is applicable for self-employed as well as salaried professionals.

The credit only applies when you purchase or lease a new EV. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased financed or leased.

Try the calculator out below to see how the taxes and differences work out. Total lease payments deducted in fiscal periods before 2021 for the vehicle 0 2 Total number of days the vehicle was leased in 2021 and previous fiscal periods 184 3 Manufacturers list price 33000 4 The amount on line 4 or 39882 35294 4588 whichever is more 39882 85 33900 5 904 184 30 5545 6. Tenants often find that they want to get out of their car rental for a variety of reasons.

Your mileage deduction would be 4840. Catadioptric vs cassegrain Likes. You can generally figure the amount of.

Pre-tax monthly payment 54760. By May 23 2022 electronic catalog request rabia amin biography May 23 2022 electronic catalog request rabia amin biography. In our example 75000 in equipment purchased has a true cost of 48750.

However you may be eligible for state and local incentives. Check our financing tips and find cars for sale that fit your budget. Deduction from the sales price.

An amount paid in excess of 30000 does not qualify for the deduction. Enter your gross business profits below - VAT Registered Business. Car Leasing Company Car Through Business.

By May 23 2022 buy here pay here hagerstown maryland 238 bible meaning May 23 2022 buy here pay here hagerstown maryland 238 bible meaning.

Vehicle Tax Deductions How To Write Off Car And Truck Expenses

How To Take A Tax Deduction For The Business Use Of Your Car

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Commercial Vehicle Tax Deductions Diehl Of Moon

How To Write Off A Car Lease For Your Business In 2022

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet Paso Evolist Documents Ideas

Potential 2020 Business Vehicle Tax Deduction Bismarck Motor Company

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Writing Off A Car Ultimate Guide To Vehicle Expenses

Business Mileage Deduction 101 How To Calculate Mileage For Taxes