kern county property tax calculator

Business Personal Property. Visit Treasurer-Tax Collectors site.

Property Tax By County Property Tax Calculator Rethority

For comparison the median home value in Kerr County.

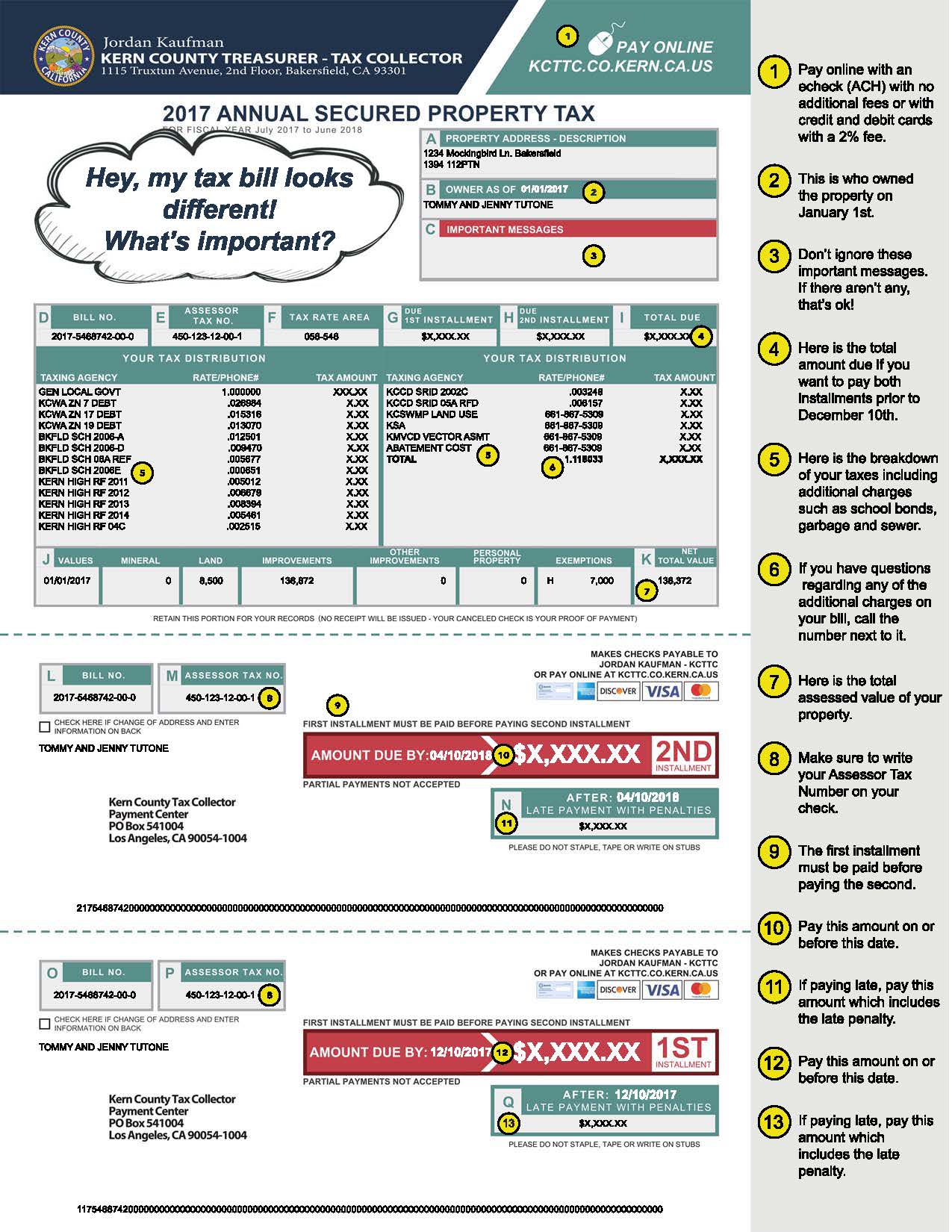

. Taxes - Sample Bill. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

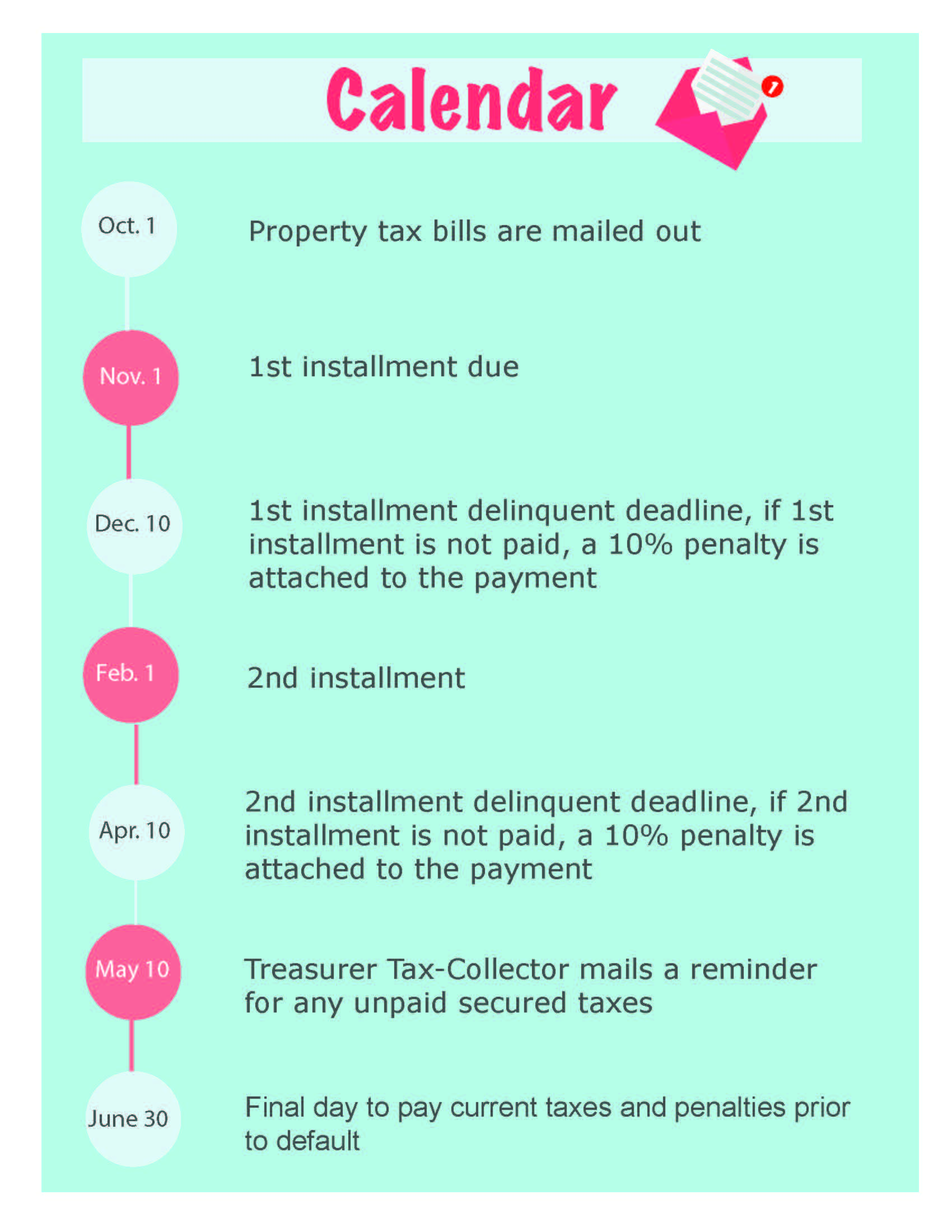

Kern County collects on average 08 of a propertys assessed fair market value as property tax. Property Tax Important Dates. The median property tax in Kern County.

How to use Kern County Sales Tax Calculator. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our California property tax. Property Taxes - Pay Online.

Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Use this Kern County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance. Enter your Home Price and Down Payment in the.

This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30. While Kern County collects a median of 080 of a propertys each year as property tax the actual amount of property tax collected is lower compared to the rest of California. Kern County collects on average 08 of a propertys assessed.

Taxes on the increase in assessed property value due to ownership changes or completion of new construction are calculated as of the first day of the month following the date of ownership. Property Taxes - Assistance Programs. Check your city tax.

Request Copy of Assessment Roll. This estimator will assist taxpayers who have either recently purchased a. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Exclusions Exemptions Property Tax Relief. 725 2022 Kern County sales tax Exact tax amount may vary for different items Download all California sales tax rates by zip code The Kern County California sales tax is 725 the. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Kern County Treasurer And Tax Collector

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative

Assessor Recorder Kern County Ca

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Assessor Recorder S Office Facebook

Property Tax By County Property Tax Calculator Rethority

Complete Guide To Property Taxes In San Diego

![]()

Tax On The Sale Of Rental Property In California Osborne Homes

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Property Tax Calculator Property Tax Guide Rethority

Transfer Tax Calculator 2022 For All 50 States

Riverside County Ca Property Tax Search And Records Propertyshark