us exit tax calculation

Citizenship they may owe Expatriation Tax The Expatriation Tax is a capital gains. The US exit tax applies to several different types of assets that may be owned by an expatriate and is calculated differently for each type.

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

US Exit Taxes.

. Exit taxes are relevant because some taxable income such as capital gains on home ownership is not. Exit tax is calculated using the form 8854. Non - U S.

Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US. When a person expatriates or gives up their US. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Ad Learn About Taxation And Use Our Discussion Questions To Create Productive Conversations. The Price of Renouncing Your Citizenship. Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

The defining feature is that assets are treated as if they are sold on. The US Exit Tax calculation is not. Instead exit tax is an attempt by the US government to consolidate your US tax affairs.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Exit tax is calculated using the form 8854. Should We Tax The Rich At A Higher Rate Or Is Taxation Theft.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Next is to determine if an exception applies. Ad Aprio performs hundreds of RD Tax Credit studies each year.

In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and. Assets that havent been taxed yet such as capital gains on homeownership or funds in. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five years is over.

Find Out More Today. Partner with Aprio to claim valuable RD tax credits with confidence. The exit tax rules impose an income tax on someone who has made his or her exit from the US.

Currently net capital gains can be taxed as high as. Citizen or Legal Permanent Resident. Watch our Exit Tax video Part 2 to understand how to calculate the Exit Tax forms to file and some considerations after youve gone through the Exit Tax.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation. How is Exit Tax Calculated. The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs.

Essentially the first step is to determine if you qualify as US. For purposes of calculating the exit tax the built - in gain or loss of each asset is computed by subtracting the assets adjusted basis from the assets FMV id. The HEART Act also added the inheritance tax a 40 flat tax on.

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax Quintessential Tax Services Us And International Tax Services And Consultation

U S Expatriation The U S Exit Tax

U S Exit Tax And Fatca 30 Withholding

Easiest 2021 Fica Tax Calculator

Us Exit Taxes The Price Of Renouncing Your Citizenship

Sales Tax And Compliance Taken Care Of On Your Behalf Tax Compliance Paddle

Part 1 Facts Are Stubborn Things The Possible Effect Of The Us Exit Tax On Canadian Residents U S Citizens And Green Card Holders Residing In Canada And Abroad

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

United States Taxation Of International Executives Kpmg Global

Once You Renounce Your Us Citizenship You Can Never Go Back

Navigating The Tax Implications Of The Covid 19 Pandemic Fisher College Of Business

Never Give Up Or You Ll Be Surprised

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

How Much Will Your Stimulus Check Be Use This Calculator Cnn Politics

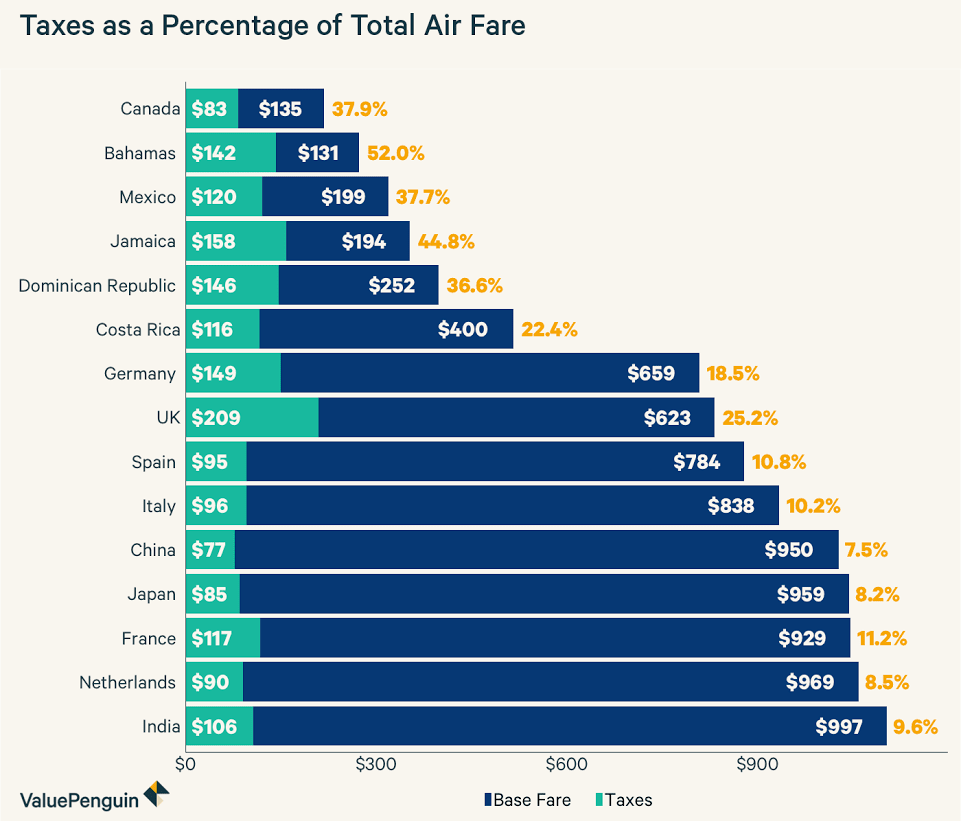

The Taxes That Raise Your International Airfare Valuepenguin

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Exit Tax In The Us Everything You Need To Know If You Re Moving

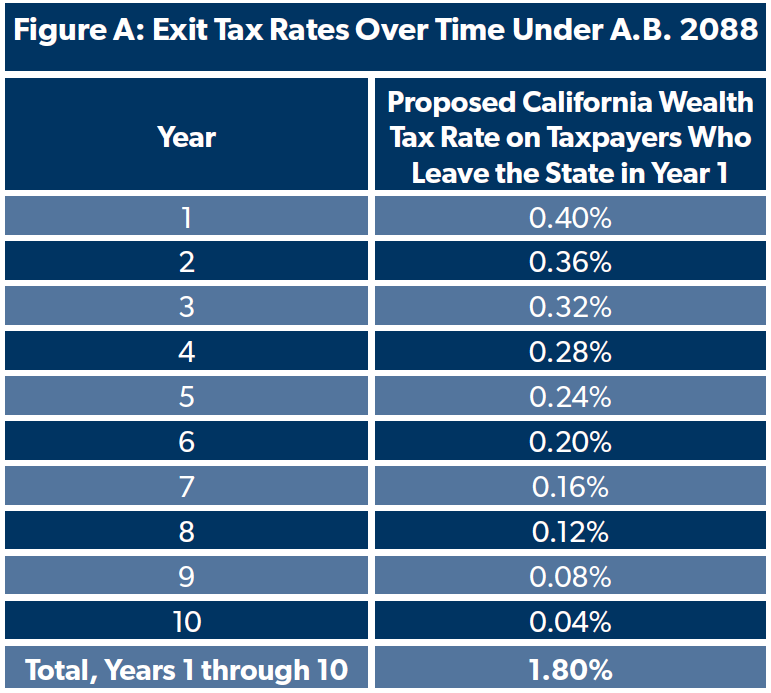

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union